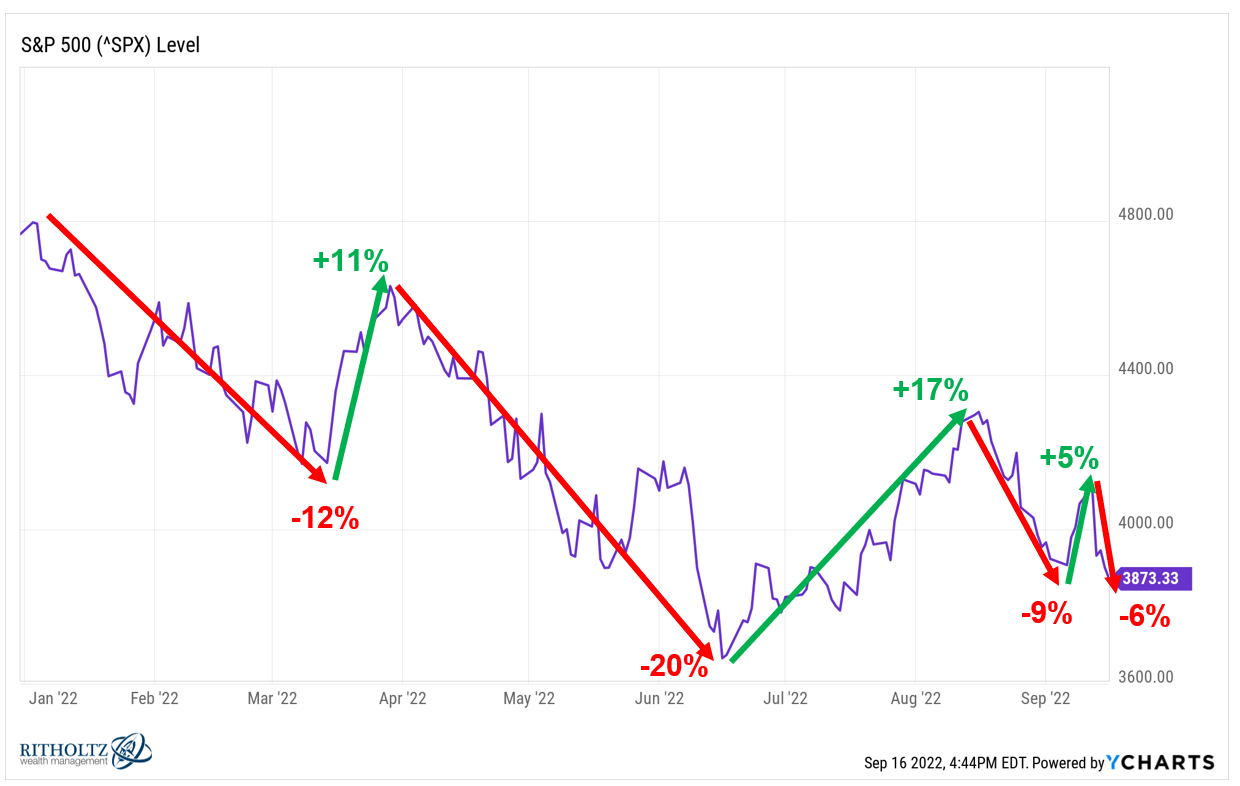

Earlier this week I posted a chart displaying how unstable the inventory market has been this 12 months:

Issues have gotten much more unstable since then.

This submit prompted the next response from somebody on Twitter experiencing their first bear market:

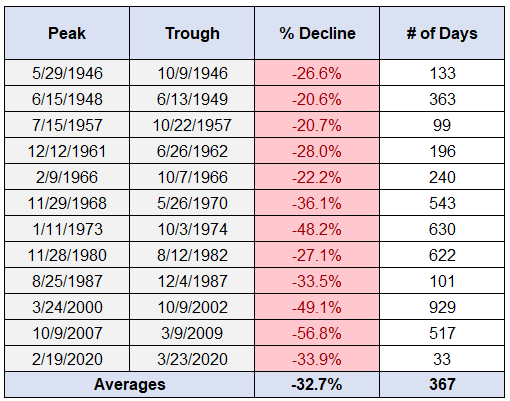

Sure, there may be precedent for this.

These are all the bear markets since World Conflict II:

If something, it’s shocking the present iteration isn’t down extra.

Inflation is raging at 40 12 months highs. Rates of interest are rising at their quickest tempo in historical past. Federal Reserve officers are actively rooting for the inventory and housing markets to crash. The Fed is making an attempt to orchestrate a recession.

But the S&P 500 is down simply 21% or so from its all-time highs. That’s not even a mean bear market.

Perhaps we have now additional to fall. Perhaps not. However both manner, in case you’re going to spend money on shares you must get used to this.

Right here’s what I wrote in my most up-to-date ebook about how I take into consideration downturns:

Within the coming 40-50 years I’m planning on experiencing a minimum of 10 or extra bear markets, together with 5 or 6 that represent a market crash in shares. There will even most likely be a minimum of 7-8 recessions in that point as effectively, perhaps extra.

Can I ensure of those numbers? You possibly can by no means ensure of something relating to the markets or financial system however let’s use historical past as a tough information on this. Over the 50 years from 1970-2019, there have been 7 recessions, 10 bear markets and 4 reliable market crashes with losses in extra of 30% for the U.S. inventory market. Over the earlier 50 years from 1920-1969, there have been 11 recessions, 15 bear markets, and eight reliable market crashes with losses in extra of 30% for the U.S. inventory market.

Each a type of bear markets and recessions had been distinctive in their very own manner. This one is in contrast to something we’ve ever seen earlier than if you throw within the pandemic, authorities spending spree, damaging rates of interest, provide chain shocks and such.

Markets are continuously altering and evolving over time. In some methods, it’s totally different with each bear market.

In different methods, it’s the identical each time, particularly relating to human nature which is the one fixed all through historical past.

Each bear market causes emotions of panic and despair. They make you query your beforehand held investing beliefs. They pressure you to contemplate whether or not or not you could have the intestinal fortitude to stay together with your long-term investing plan.

I’m not going to sugarcoat it for you — bear markets are painful. Each single considered one of them (even in case you’ve skilled a handful up to now).

However in case you’re a younger investor, at present’s scenario is significantly better than the place we had been 9-18 months in the past.

The S&P 500 is now down a bit of greater than 20%. The Russell 2000 is down nearly 30%. The Nasdaq 100 is down greater than 30%.

Shares are on sale. They might get marked down even additional however I don’t assume too many younger individuals are going to remorse shopping for shares proper now after they look again in 15-20 years.

Are you able to imagine the place you could possibly have purchased shares in 2022? somebody is sure to say within the 2030s when millennials are of their peak earnings years and gobbling up shares.

Not solely are inventory costs decrease however you possibly can lastly earn some yield in your money.

For years I’ve been bombarded with questions from younger folks about the place to stash their money whereas they save for a down fee or wedding ceremony or emergency fund when there was no yield available.

Guess what?

We lastly have some yield!

Brief-term treasuries are actually yielding 4%. Meaning greater charges on financial savings accounts, CDs, cash markets and short-term bond funds.

Costs are down for monetary property however anticipated returns are rising.

So long as you’re making common contributions to your retirement account, brokerage or financial savings account, the scenario has improved this 12 months.

It doesn’t really feel prefer it as a result of everybody could be very indignant proper now with the mixture of excessive inflation and quickly rising rates of interest.

It’s troublesome to disregard all of that negativity so the best choice for younger folks is to automate as a lot of the investing course of as you possibly can.

Automate your financial savings so that you don’t have to consider it. Automate your retirement contributions so that you don’t permit unhealthy days or months to have an effect on your multi-decade time horizon. Automate your funding purchases on a periodic foundation so that you’re not tempted to time the market.

The extra good selections you can also make forward of time the simpler it’s to keep away from the painful feelings which might be led to by the inevitable bear markets.

Issues may worsen earlier than they get higher.

In case you’re a internet saver within the years forward, that’s a great factor.

We talked about this query on the newest version of Portfolio Rescue:

Taylor Hollis joined me this week to debate questions on property planning for a rising household, saving for retirement, shopping for vs. leasing a brand new automobile, incomes earnings by way of choices and extra.

Right here is the podcast model of this week’s episode: